Cash-Out Refinance, Refinance Your Mortgage - eLEND Can Be Fun For Anyone

Cash out refinance — pros and cons - CNN Underscored for Dummies

Kinds Of Cash-out Refinance loans readily available Conventional Cash-out Refinancing A standard cash-out refinance is usually easier to acquire than an FHA or VA refinance, both of which have unique eligibility standards. Nevertheless, Research It Here -out refinances still have earnings and credit rating requirements. VA Cash-out Refinancing FHA Cash-out Refinancing If you qualify, government-backed FHA and VA cash-out refinances provide attractive terms.

Prepared to start? Our home loan officers can address all of your house refinance concerns and assist you discover the mortgage that's right for you.

The smart Trick of Cash Out Refinance Home Loan Lenders StLouis, Missouri That Nobody is Talking About

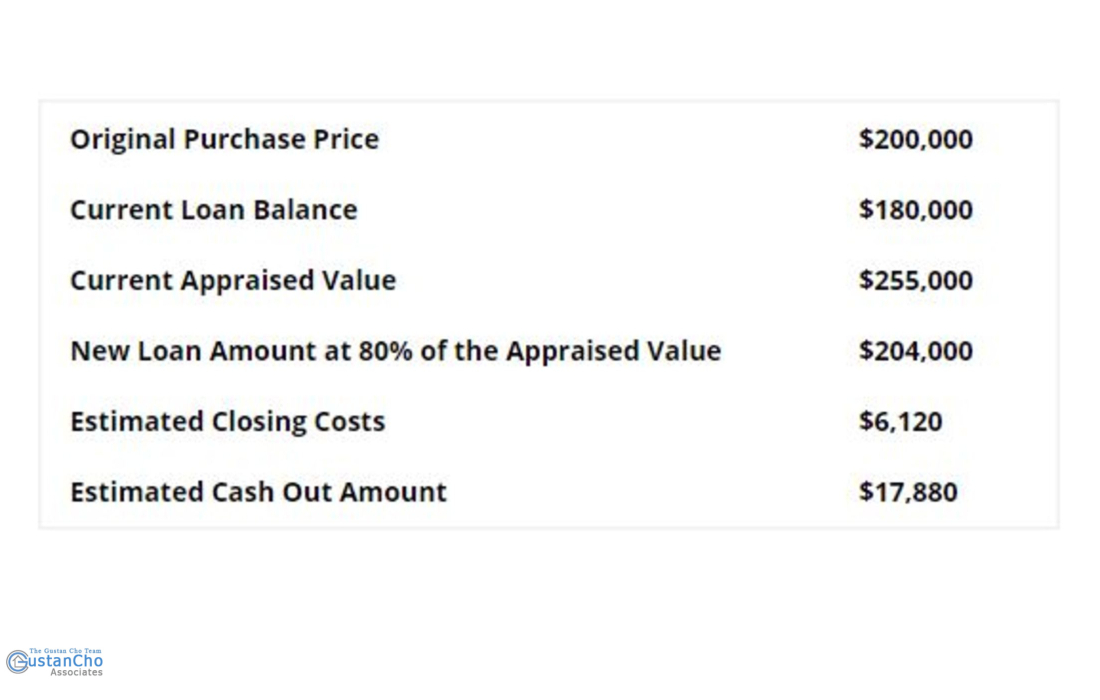

What is cash-out refinancing? Cash-out refinancing changes your existing mortgage with a larger home loan, enabling you to benefit from the equity you have actually developed in your house and gain access to the distinction between the two home loans (your current one and the brand-new one) in cash. The money can go towards virtually any function, such as house improvement, consolidating high-interest debt or other financial objectives.

Beginner's Guide to Cash-Out Refinance - Mortgage - Chase.com

Cash-Out Refinance Definition

In a cash-out re-finance, you can do the exact same, and likewise withdraw a portion of your home's equity in a swelling sum."Cash-out refinancing is useful if you can decrease the interest rate on your main home mortgage and make great usage of the funds you secure," says Greg Mc, Bride-to-be, CFA, Bankrate chief monetary expert.

Things about Cash-Out Mortgage Refinance - Home Loan - NASA Federal

Otherwise, the steps to do this sort of re-finance should resemble when you first got your home mortgage: Send an application after choosing a lending institution, supply needed documents and await an approval, then wait out the closing. Here's how you may prepare for a cash-out refinance:1. Figure out the loan provider's minimum requirements, Mortgage lending institutions have different qualifying requirements for cash-out refinancing, and a lot of have a minimum credit score the higher, the much better.

As you explore your options, take note of what these requirements are. 2. Calculate the precise quantity you need, If you're thinking about a cash-out re-finance, you're likely in requirement of funds for a specific function. If you aren't sure what that is, it can be practical to nail that down so you obtain just as much as you need.